top of page

Our Solutions

Investors, Lenders and Allocators

Pick among the top performing crypto hedge funds and discover new strategies

Discover new verified strategies

Track all your applications on one platform. Communicate directly with managers and shortlist, reject or book an allocation

Track and manage applications

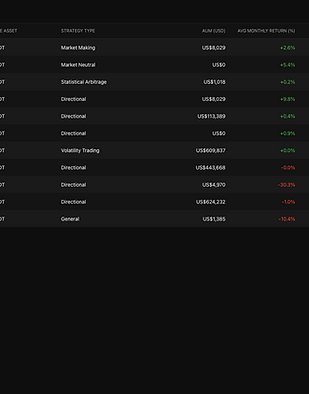

Dynamic, verified factsheets that allows you to drill into the performance and risk

Drill into the data

Unique tools that lets you solve for the best correlation, performance and risk metrics across a number of strategies.

Find the best allocations

Traders and Managers

Upload and track your strategies

Easy to set up multiple strategies and pull directly from the exchanges where you trade with read-only api keys.

Make applications for loans, SMA or investments directly

Complete the custom DD and apply directly with any of the allocators and investors on the platform

Your own dynamic and verified factsheet.

We track balances and provide all the common performance and risk metrics which are updates every 5 mins.

Track and Manage your applications

Follow up on requests and view the status of your applications in real time.

bottom of page